A holistic approch

To sustainability.

ECONOMIC PERFORMANCE

GRI Standards

| GRI 201: Economic Performance | Sections/Comments | |

|---|---|---|

| GRI 103-1 | Management approach: Explanation of the material topic and its boundary | |

| GRI 103-2 | Management approach: The management approach and its components | |

| GRI 103-3 | Management approach: Evaluation of the management approach | |

| GRI 201-1 | Direct economic value generated and distributed | Net revenue: ₹ 7,081 crores Profit after Tax: ₹ 486.43 crores |

| GRI 201-2 | Financial implications and other risks and opportunities due to climate change | In response to the pressing environmental challenge of climate change, KNPL has adopted the Task Force on Climate-related Financial Disclosures (TCFD) framework in FY 2022-23 to assess and quantify its risks and opportunities. We have integrated the identified risks with our Enterprise Risk Management strategy |

| GRI 201-3 | Defined benefit plan obligations and other retirement plans | Employee Benefits (Note 32, 39) |

| GRI 201-4 | Financial assistance received from government | Company received no financial assistance from government |

Financial Performance

A summary of the Company’s standalone financial results for the year ended 31st March 2023 (FY 2022-23) vis-a-vis standalone financial results for the previous year (FY 2021-22) is as under:

| FY 2022-2023 | FY 2021-2022 | |

|---|---|---|

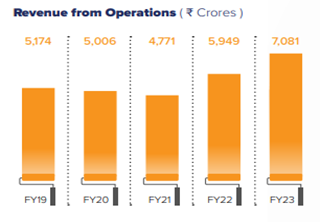

| Revenue from operations | 7,081.02 | 5,948.90 |

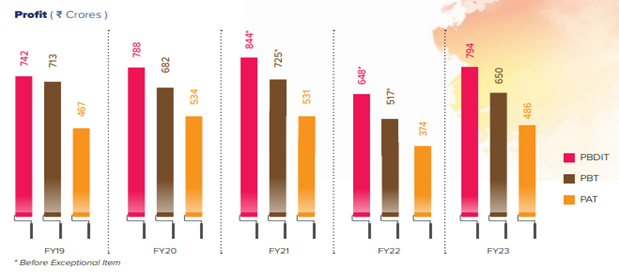

| Profit before Depriciation, Interest, Exceptional item and Tax | 793.89 | 647.34 |

| Less: Depriciation and Amortisation | 164.63 | 153.82 |

| Profit before Interest, Exceptional item and Tax | 629.26 | 493.52 |

| Less: Interest | 9.73 | 9.87 |

| Less: Exceptional item | - | -11.39 |

| Add: Other income | 30.83 | 32.86 |

| Profit before tax | 650.36 | 505.12 |

| Less: Tax Expenses | 163.93 | 130.79 |

| Profit after tax | 486.43 | 374.33 |

| Other Comprehensive income | 0.16 | 2.51 |

| Total Comprehensive income for the year | 486.59 | 376.84 |

(₹ in Crores)

Revenue from Operations for the year aggregated to ₹ 7,081.02 Crores as compared to ₹ 5,948.90 Crores for the previous year, reflecting a growth of 19.0%.

Average Crude oil prices during the year increased from USD 79.8/bbl to USD 92.6/bbl, a jump of 17% over the last year. The currency further depreciated during the year, impacting raw material prices.

Inflation which was very high at the beginning of the year started tapering downwards towards the second half of the year, which helped in some margin improvement.

The Company continued its efforts to control overheads, and all departments worked on their tasks and achieved the result.

During the period, the Company granted 11,92,792 restricted stock units to eligible employees as determined by the Nomination and Remuneration Committee of the Company. Consequently, employee benefits expense includes a provision of ₹ 3.75 Crores made towards Share-Based Payment Expense for the year ended 31st March, 2023.

PBDIT for the year was higher at ₹ 793.89 Crores compared to ₹ 647.34 Crores, reflecting a growth by 22.6%. Depreciation for the year was ₹ 164.63 Crores, slightly higher compared to the previous year.

Other income was lower at ₹ 30.83 Crores as compared to ₹ 32.86 Crores in the previous year.

PBT for the year was ₹ 650.36 Crores as compared to ₹ 516.51 Crores (before exceptional item) of the previous year, reflecting a growth of 25.9% over the previous year. PAT was higher at ₹ 486.43 Crores compared to ₹ 374.33 Crores, reflecting growth of 29.9%.

The Company did not accept any deposits covered under Chapter V of the Companies Act, 2013, during the year. There were no significant or material orders passed by any Regulators, Courts or Tribunals against the Company which could impact its going concern status and the Company’s operations in future.

There was no change in the nature of business during the year. There were no material changes and commitments affecting the financial position of the Company that occurred between the end of the financial year of the Company to which the financial statements relate and the date of this Report.

Way Forward

Budgeting and Control The agenda and preparations for the coming fiscal year are set at KNPL at the beginning of the year, and include the development of a complete yearly business plan. A detailed annual budget is prepared by the Management Committee, which includes functional heads, Managing Director, and then approved by the Board of Directors, based on the annual business plan and macro environment, including currency value, raw material costs, and energy costs, among other things. The Company monitors the budget using several IT platforms and has devised multiple system checks to keep it under control. The functional heads and the Management Committee review the budget on a regular basis.

Revenue from Operations (₹ in Crores)

PROFIT (₹ in Crores)

*Before exceptional item (Net of Tax)

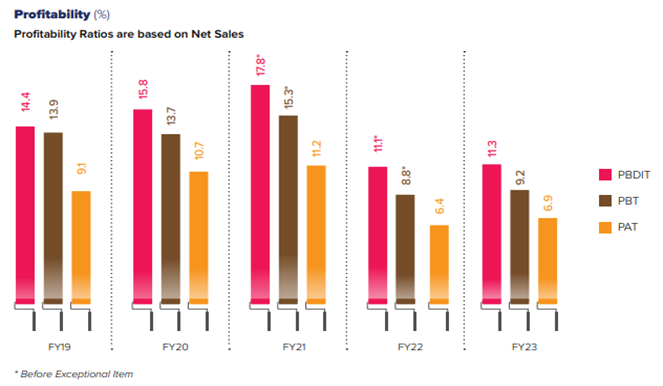

PROFITABILITY (%)

Profitability ratios are based on Net Sales

*Before exceptional item

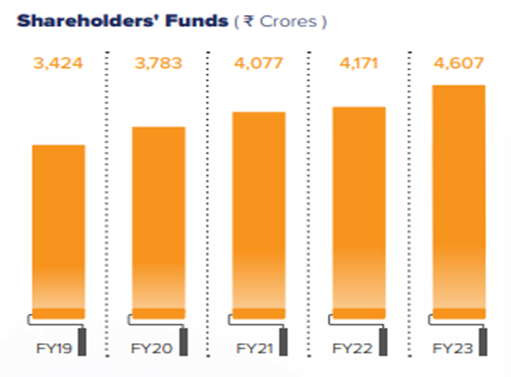

SHAREHODERS’ FUNDS (₹ in Crores)

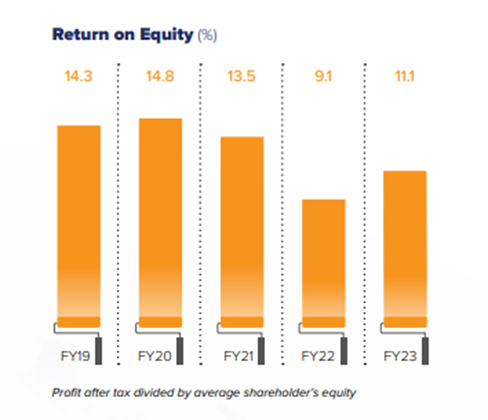

Return on Equity (%)

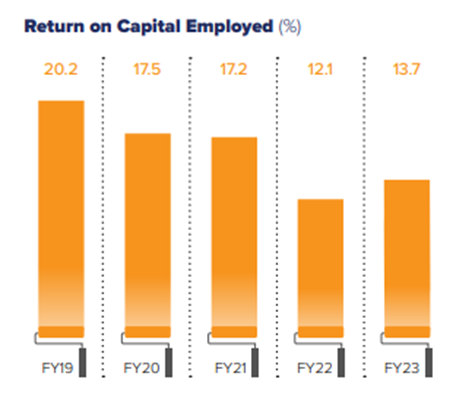

RETURN ON CAPITAL EMPLOYED (%)

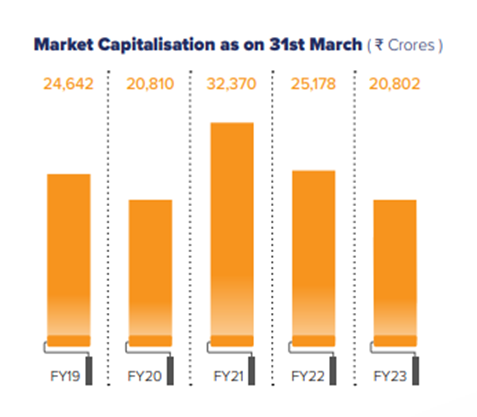

MARKET CAPITALISATION as on 31st March (₹ in Crores)

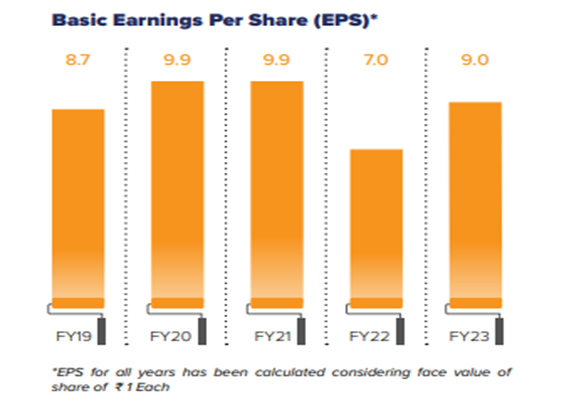

EARNINGS PER SHARE (EPS) (₹)

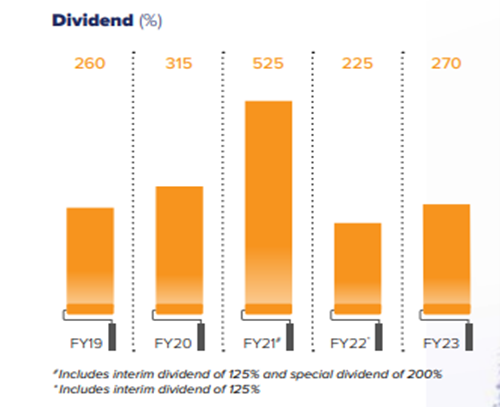

DIVIDEND (%)

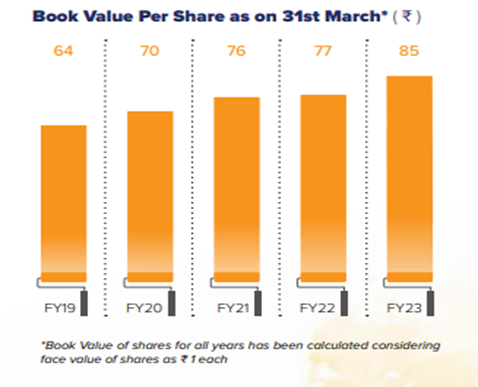

BOOK VALUE PER SHARE as on 31st March (₹)